Are property developers paying too much SDLT?

The plain fact is that, too often, developers overpay SDLT due to lack of proper advice. Those calculating the SDLT liability, this includes solicitors and accountancy practices, commonly rely on HMRC’s SDLT calculator.

This is far too blunt an instrument to deal with the calculation of a tax which can be so intricate. Put simply, the SDLT calculator is probably one of the biggest money spinners that HMRC possesses.

Common errors which occur when calculating SDLT:

Getting the ‘effective date’ wrong

The effective date

This is the date that the SDLT tax liability occurs, many consider that date to be the day of completion, this could well be the case. The rules actually state that the effective day can be the date of completion, or the date on which the contract is ‘substantially performed’ whichever is earlier.

Substantial performance can be when most of the purchase price is paid, or when the purchaser has unfettered access to the land. In some cases, substantial performance could take place well before the actual date of completion, triggering a liability that the developer is not prepared for.

It is important developers are in control of the effective date.

Not recognising ‘mixed use’ property

Mixed use property

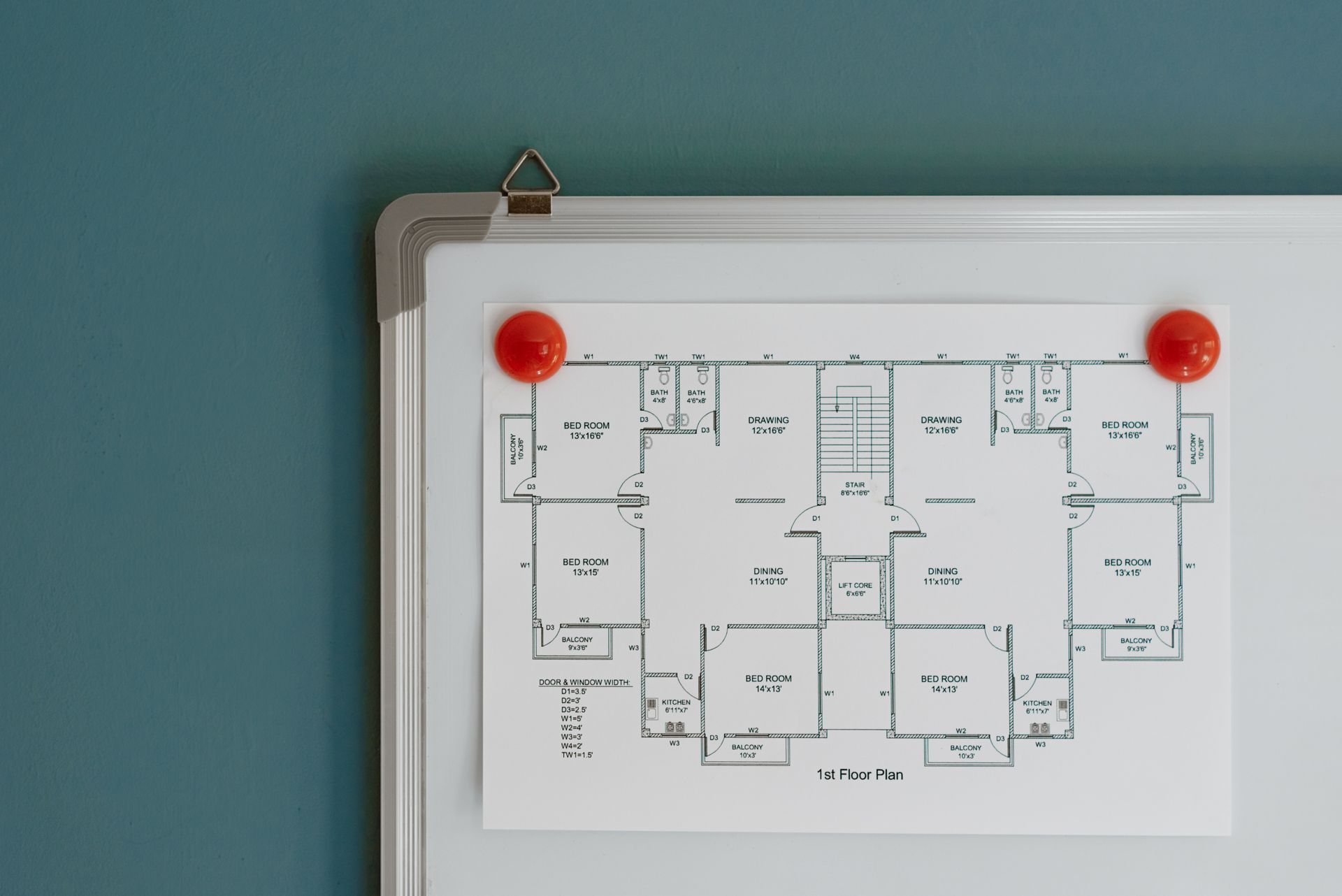

A transaction comprising both residential and non-residential components can vastly reduce the SDLT liability. Developers should be mindful of the mixed-use rules when putting together a purchase.

Not recognising ‘linked transactions’

Linked transactions

When a series of transactions between the same buyer and seller are carried out together, they can treated as a single transaction with regards to SDLT. This can be advantageous as it can sometimes change the subject matter of the purchase from residential to non-residential or enable access to reliefs such as multiple dwellings relief. A substantial SDLT saving can be achieved.

Failing to claim the appropriate reliefs

SDLT reliefs – areas that are particularly problematic include:

- Recognising the point at which bare land or commercial property becomes a dwelling

- Group relief, available on the transfer of properties between companies in the same group

- There are extremely complicated rules surrounding partnerships and LLP’s. A good understanding of these can sometimes result in SDLT not being payable at all

There are multiple reliefs available in instances where:

- You buy more than one dwelling

- A building company buys an individual's home

- Compulsory Purchase Orders take place

- The property developer is subject to planning conditions

- Transfers of property between companies take place

- Charities purchase property

- The purchase has taken place on a Freeport tax site

Accessing the correct SDLT advice

SDLT can represent a significant expense for property developers, so it is vital that proper advice is sought.

Friend Partnership has detailed knowledge on the subject and have been advising clients for decades. It is our aim to ensure that our clients correctly understand the nature of their transaction, control the timing of any tax liability and claim all the available reliefs.

Make A SDLT Enquiry

Thank you for contacting Friend Partnership.

Your Enquiry is important to us, and we will duly get back to you as soon as possible.

Regards,

Please try again later.

KNOWLEDGE BASE

OTHER SERVICES WE PROVIDE

Registered to carry out audit work in the UK and regulated for a range of investment business activities by the Institute of Chartered Accountants in England and Wales

Company registration number: 07746831