Stamp Duty Land Tax (SDLT) is charged on property transactions in the UK where the value is above certain thresholds.

(If you purchase a property in Scotland, you no longer pay SDLT, instead, you pay Land and Buildings Transaction Tax)

(If you purchase a property in Wales, you no longer pay SDLT, instead, you pay Land Transaction Tax)

To assist people in calculating their SDLT liability, HMRC provides an online calculator. Whilst this may be useful for the most basic of transactions, the calculator is far too blunt a tool to be of use for a large proportion of property transactions.

SDLT is charged either at residential property rates or at non-residential property rates. Where a transaction involves a residential property and its grounds (but nothing else) the residential rates apply. If the transaction involves commercial property or property which is part residential and part commercial (known as mixed use) the non-residential rates apply.

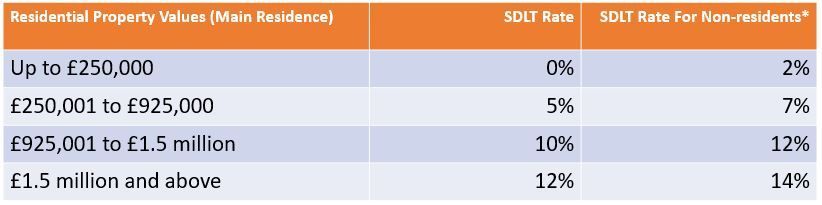

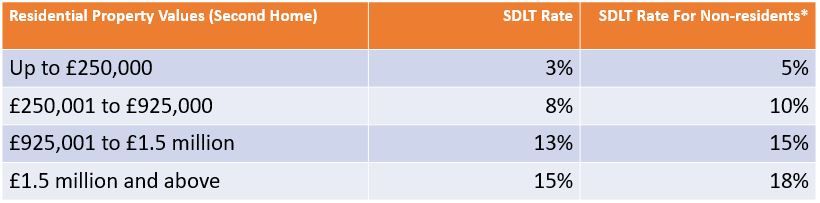

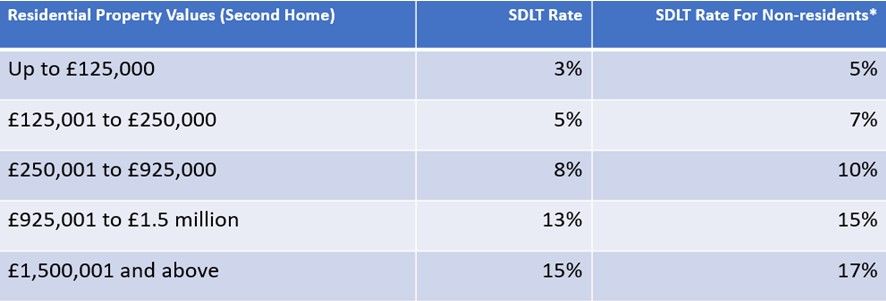

The current residential rates of SDLT on property completions from 23rd September 2022 are as follows:

* There is a 3% surcharge over and above these rates for certain transactions. This includes the purchase of a second homes or a replacement main residence where, by the date of completion the previous main residence has not yet been sold. In the latter instance a refund of the surcharge can be claimed if the original main residence is sold within the available time limit.

* There is a 2% surcharge for property purchases where at least one of the purchasers are non-resident in the UK

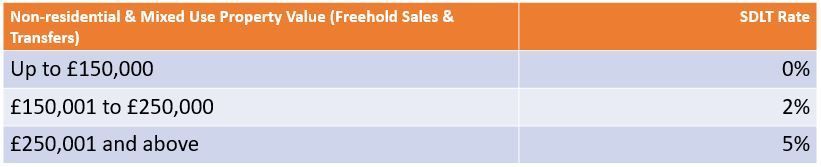

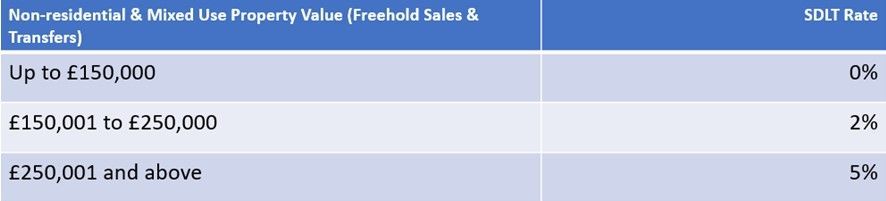

Stamp Duty Land Tax on non-residential or mixed use property

When purchasing a new non-residential or mixed use property, the non-residential rates of SDLT apply.

These are:

For leasehold properties, the SDLT value is based on the rent rather than the properties actual value.

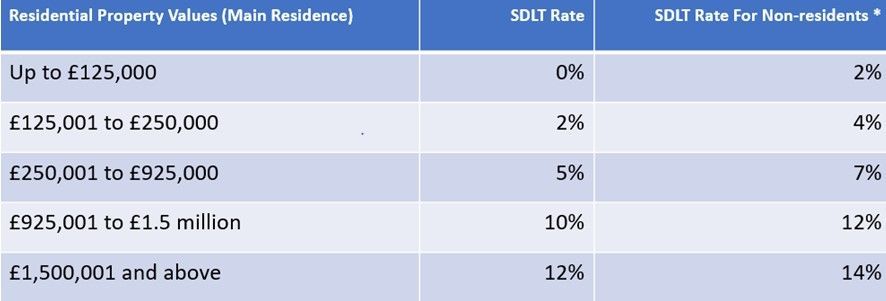

For rates of SDLT on property completions between 1st October 2021 and 22nd September 2022, they are as follows:

The effective date

This is the date that the SDLT tax liability occurs, many consider that date to be the day of completion, this could well be the case. The rules actually state that the effective day can be the date of completion, or the date on which the contract is ‘substantially performed’ whichever is earlier.

Substantial performance can be when most of the purchase price is paid, or when the purchaser has unfettered access to the land. In some cases, substantial performance could take place well before the actual date of completion, triggering a liability that the developer is not prepared for.

Owning property through a company

Purchases by Partnerships, Limited Companies and LLP’s are extremely complicated and a detailed understanding of the rules that apply in these circumstances is important to ensure that SDLT is not overpaid.

SDLT reliefs

The SDLT rules contain a number of reliefs which are available to reduce the tax liability on the acquisition of property. These reliefs are massively underused so many property buyers end up paying too much SDLT.

SDLT can be mitigated using reliefs where more than one dwelling is being purchased at the same time. It can also be reduced by correctly recognising the subject matter of transactions which are linked with each other or even by correctly identifying when property becomes residential.

The importance of correct SDLT advice

As SDLT rates rise the tax liability forms a greater and greater part of the purchase cost. The rules provide for a number of reliefs from SDLT which, when correctly applied, can substantially reduce that tax liability. Obtaining correct specialist advice is vital.

At Friend Partnership we have many years’ experience in advising our clients on SDLT and have a very detailed knowledge of the rules, reliefs and potential pitfalls.

Make A General SDLT Enquiry

KNOWLEDGE BASE

OTHER SERVICES WE PROVIDE