Employee Ownership Trusts – are they coming into their own?

The beginning of 2020 saw a tightening of the rules for Entrepreneurs Relief (which we must now call Business Asset Disposal Relief) and a slashing of the lifetime limit from £10 million per person to £1 million.

There is also now a distinct possibility that the rates of Capital Gains Tax will be aligned with Income Tax rates in 2021, or possibly 2022. The timing of the increase may depend on the level of pressure that jittery Conservative MPs, worried about the effect of tax rises at the ballot box, are able to exert on the Chancellor.

The restrictions on Business Asset Disposal Relief and the likely increase in tax rates mean that the tax cost of exiting for business owners is going to be higher than we have been accustomed to. As a result, we have seen a distinct increase in enquiries about Employee Ownership Trusts (EOTs).

Why do we think we are seeing this increased level of interest? Put simply, it is because using an EOT provides a tax-free exit for corporate business owners and provides an incentive for employees, together with the ability for them to receive a tax-free bonus of up to £3,600 per tax year.

As you would expect, where there are such generous tax breaks, there is a raft of qualifying conditions that must be met. These are some of the key requirements:

- The existing shareholder must sell a controlling interest in the company to the EOT Trustees.

- All employees must be able to benefit from the EOT on the same terms. Obviously, there can be differentials between the level of benefit different employees receive, but that differential can only be by reference to the level of their remuneration, their length of service or their hours worked.

There are a number of other conditions but if they are all met the sale of the shares gives rise to no tax liability for the vendor whatsoever.

As you would expect, the shares need to be independently valued and that value needs to be agreed by the EOT Trustees.

Business owners who are considering using an EOT also need to give some thought to how the EOT is going to fund the purchase of the shares. The usual options available are a transfer of funds from the company to the EOT, loan notes, external funding, or a combination of these.

Serious consideration should also be given to the question of who the Trustees should be. There is no reason why a vendor cannot remain on the board of the company and/or hold the position of Trustee as well. Obviously, there would need to be careful consideration in addressing the question of conflict of interest. In many cases, the Trustee is a company limited by guarantee and the directors of that company will include employees, the vendor, and an independent person. The use of the company limited by guarantee affords protection from personal liability for those individuals.

EOTs have been with us since 2014 but there has been limited interest in them up to now. The level of interest is certainly increasing, and it seems that the EOT is about to enjoy its day in the sun.

Friend Partnership offer a comprehensive service for business owners who chose to go down the EOT route. If this is something that you feel may be appropriate to you, we will be happy to have a no obligation discussion with you to explore the subject and to look at whether it will suit you and your business. Contact David Gillies on 44(0) 121 633 2007 or via david.gillies@friendllp.com

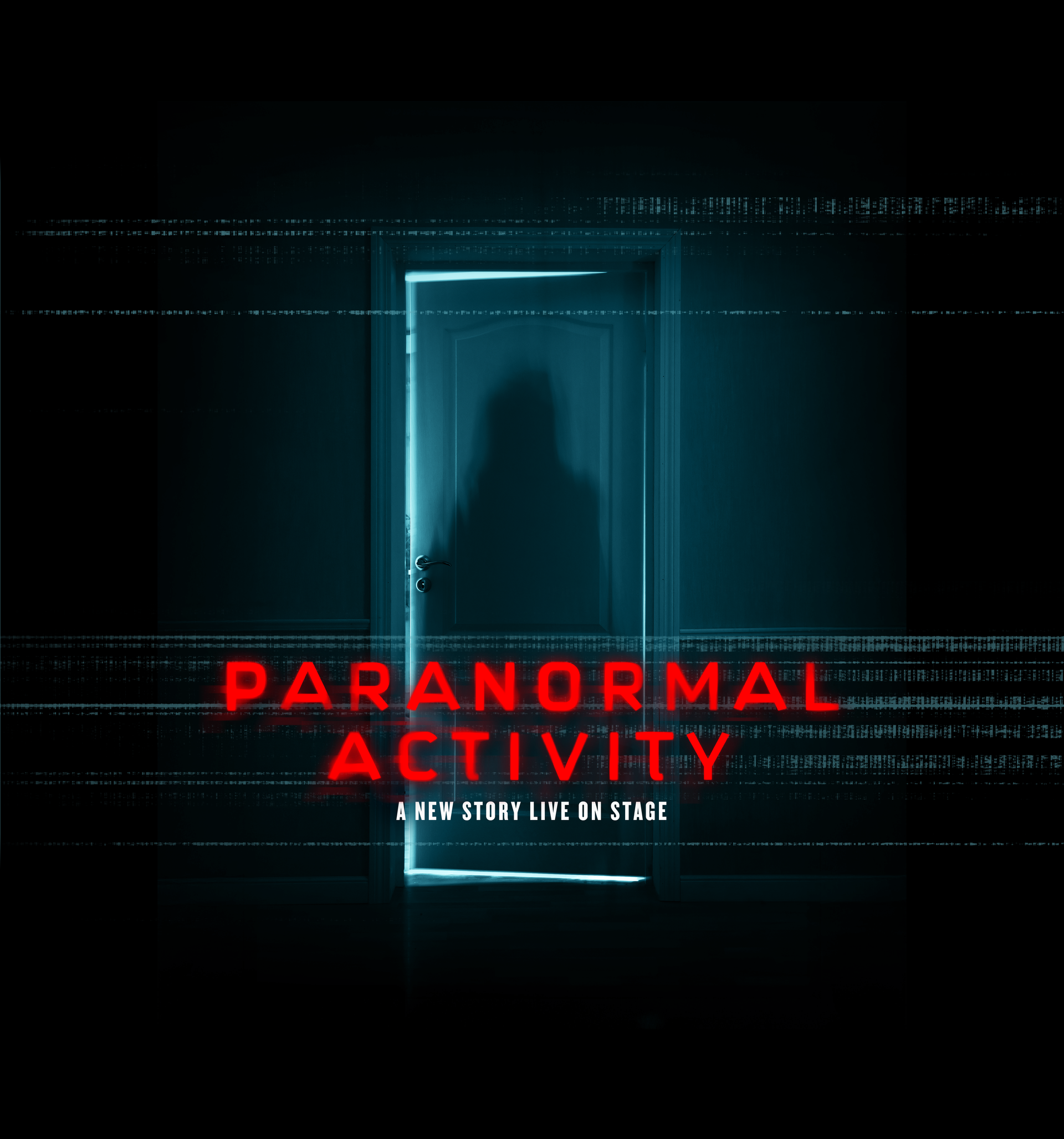

The year’s best staged production? Critical Acclaim for Melting Pot Productions’ Paranormal Activity

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: