HMRC Tax Receipts 2021/22 – A quick breakdown and summary

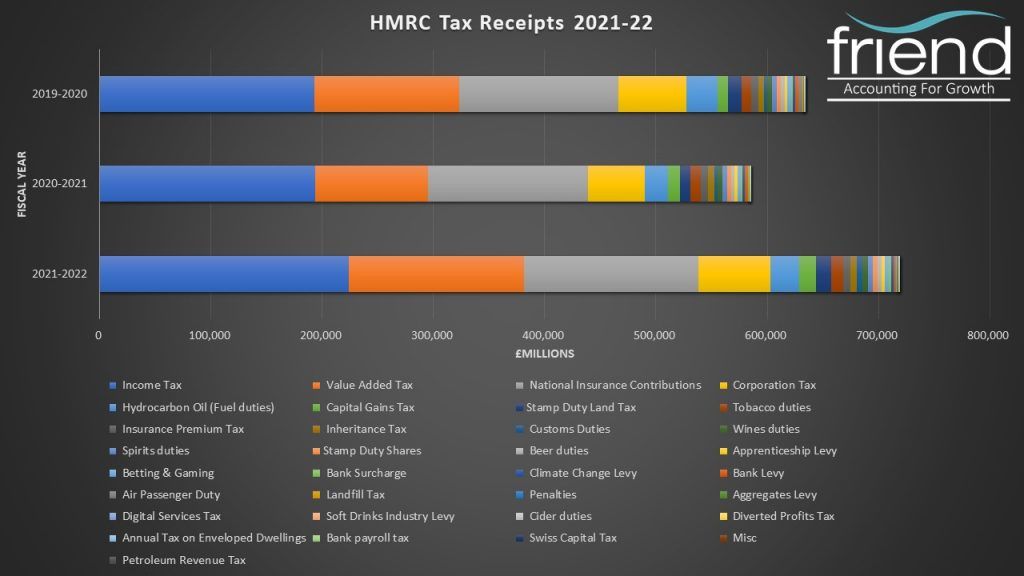

Latest HMRC tax receipts show that the UK Government has collected £718.2bn in the fiscal year 2021-22.

This is an increase of 23% compared to 2020-21 where tax receipts collected was £584.5bn and an increase of 13% compared to 2019-20 (pre-pandemic) levels where tax receipts were £633.4bn.

These are staggering figures, so soon after lockdown restrictions were lifted. Where exactly have the increases come from?

Income Tax receipts have seen an increase of 16% compared with 20/21 and a similar increase of 16% since 19/20. HMRC collecting £223bn compared with £193bn in 19/20.

National Insurance receipts have seen an increase of 9% compared with 20/21 and 10% compared with 19/20. HMRC collected £157bn compared with £143bn in 19/20.

Corporation Tax receipts have seen an increase of 27% compared to 20/21 and 5% compared with 19/20. HMRC collected £65bn compared with £62bn in 19/20.

VAT receipts have seen an increase of 55% compared with 20/21 and 21% compared with 19/20. HMRC collected £157bn compared with £130bn in 19/20

Corporation Tax is due to increase next year (25% from the current 19%). National Insurance contributions have gone up already (1.25 percentage points – increasing employee contributions from 12% to 13.25% and employer contributions from 13.8% to 15.05%). The freezing of the Income Tax allowance (£12,570) and VAT reliefs put in place during the covid pandemic for specific sectors of the economy were restored (20%). HMRC can undoubtedly be sure of collecting even larger amounts in the next fiscal year (April 2022 to March 2023).

Other notable areas of highlight in HMRC tax receipts

Tobacco, Beer, Cider, Wine & Spirits receipts are up 6% compared with 20/21 and 13% compared with 19/20. HMRC collected £23.4bn compared with £20.6bn in 19/20.

Areas that have seen decreases in revenues for HMRC are almost fully explained by the effects of covid restrictions.

Fuel Duty receipts are down 6% since 19/20, £25.9bn in 21/22 compared with £27.6 bn in 19/20.

Air Passenger Duty receipts down by 72% since 19/20, £1.0bn in 21/22 compared with £3.6bn in 19/20.

Whilst some tax receipts have gone down due to covid restrictions, others were already seeing a downward trend over the last 6/7 years.

Tax receipts from the Bank Levy are down to £1.5bn in 20/21, having slowly decreased year by year from £3.4bn in 2015/16.

Annual Tax on Enveloped Dwellings (an annual charge on UK dwellings held by a Non-Natural Person) receipts for 20/21 were £119m, which again have been declining year on year since 2015/16 when HMRC collected £178m.

Friend Partnership are a forward-thinking firm of accountants, business advisers, and corporate finance and tax specialists. Based in Birmingham.

We have detailed knowledge on the subject tax and have been advising clients for decades. It is our aim to ensure that our clients correctly understand the nature of their transaction, control the timing of any tax liability and claim all the available reliefs.

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: