HMRC Tax Receipts 2022-23 – A quick breakdown and summary

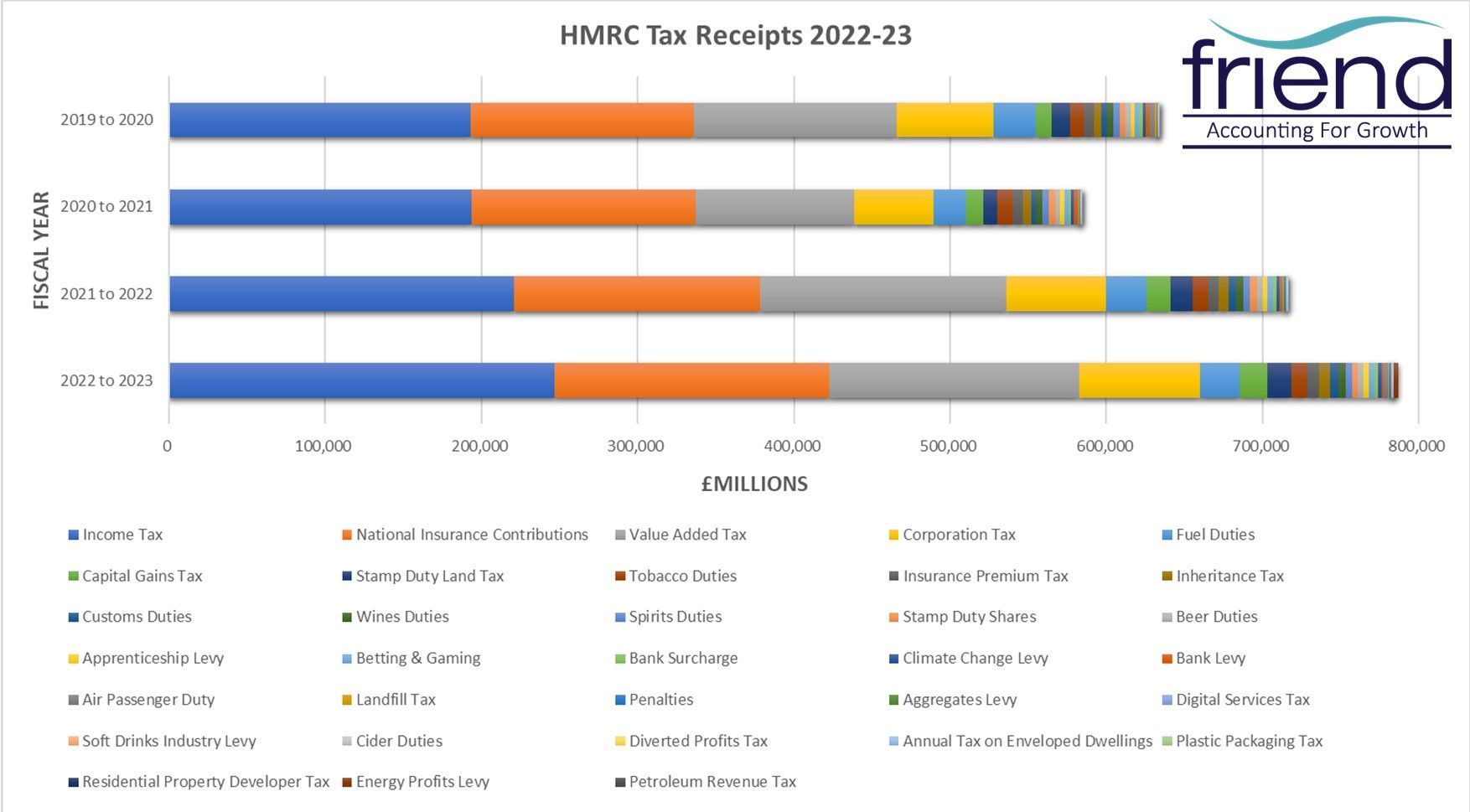

Latest HMRC tax receipts show that the UK Government has collected £786.6bn in the 2022-23 fiscal year. An increase of 9.9% compared to the £715.5bn collected in tax receipts in 2021-22.

£247bn was raised through Income Tax receipts, an increase of 11.9% from £220bn in 2021/22. Income Tax generates the highest proportion of tax revenue for the Treasury.

National Insurance receipts saw an increase of 11.3% compared with 2021/22. HMRC collected £176bn compared to £158bn the previous year.

There was a marked increase of 22.1% in Corporation Tax receipts, increasing from £64bn in 2021/22 to almost £78bn in 2022/23. The recent rise in Corporation Tax from 19% to 25% will have had no impact on the figures for 2022/23 as the changes only came into effect in April 2023. Corporation Tax receipts will undoubtedly be higher next year.

Compared to significant increases in previous years, Value Added Tax receipts only increased moderately by 1.5% in 2022/23 rising from £157.5bn to £159.7bn.

Other Notable increases in HMRC tax receipts

A 213% rise in Air Passenger Duty tax receipts was the biggest riser in 2022/23, having gone from £1.0bn in 2021/22 to £3.2bn in 2023/23. However, this is still below the levels of tax raised pre-pandemic in 2019/20 when £3.6bn was raised.

Tax Penalties saw a 30% rise from £580m in 2021/22 to £757m in 2023/23.

Inheritance Tax receipts increased by 17.1% from £6.1bn to £7.1bn, an increase of 38% since 2019. The increase can be largely attributed to the fact that many more people are falling outside the Inheritance Tax and Residence Nil Rate Band thresholds. These thresholds have remained the same since 2020 at £500,000 combined, and due to remain at the current levels until 2028. Inheritance tax receipts is expected to significantly increase in the coming years.

2022/23 saw an 18.3% increase in Capital Gains Tax receipt to £18.1bn. A trend that has seen Capital Gains Tax receipts increase by over 95% over the last 5 years. This has been largely attributed to significant increases in property values along with the sale of significant property portfolios by buy-to-let investors over the last few years. This may have been further compounded by other economic factors such as the rush to sell before the reduction in Capital Gains Tax Exemption allowance.

Notable decreases in HMRC tax receipts

Diverted Profits Tax – or the “Google Tax” as it was often colloquially referred to – saw an 81% decrease in revenues for HMRC at £42m for 2022/23. Over the past 7 years, it has generated HMRC an average revenue amount of £110m compared to the expected revenue of £350m per year.

Beers, Wines and Spirit Duties saw a decrease of 2.1%, 6.1% and 6.4% respectively.

A surprising, but not so surprising decrease sees Fuel Duty receipts down 3.2%. Whilst Fuel Duty was expected to provide more in tax receipts than pre-pandemic levels, the rise in cost of living has seemingly had a huge impact in the second half of the financial year.

New tax receipts

The Energy Profits Levy, introduced in May 2022 to respond to the exceptional profits that oil and gas companies were making, raised almost £2.8bn for the Treasury. It is notable to state that this tax levy includes a sunset clause and will expire December 2025.

Given the significant costs associated with the removal of unsafe cladding following the Grenfell Tower disaster, the government brought in a tax on profits arising from largest residential property developments that came into effect for the first time in April 2022. The Residential Property Developer Tax – a 4% tax on profits above an allowance of £25m – raised £150m in tax revenue.

*The figures above and in the tables on this page are provisional and subject to minor adjustments by HMRC.

The figures for the 2021/22 tax year can be found here HMRC Tax Receipts 2021/22 – A quick breakdown and summary

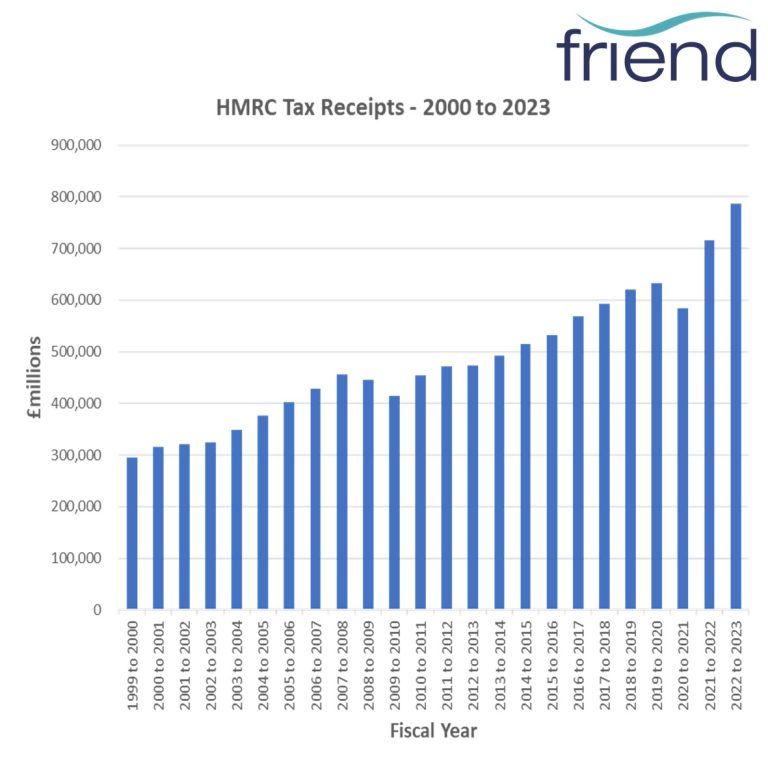

Historical figures for HMRC tax receipts between 2000 and 2023

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: