HMRC Tax Receipts 2023-24 – A quick summary

Strong Performance with Underlying Concerns

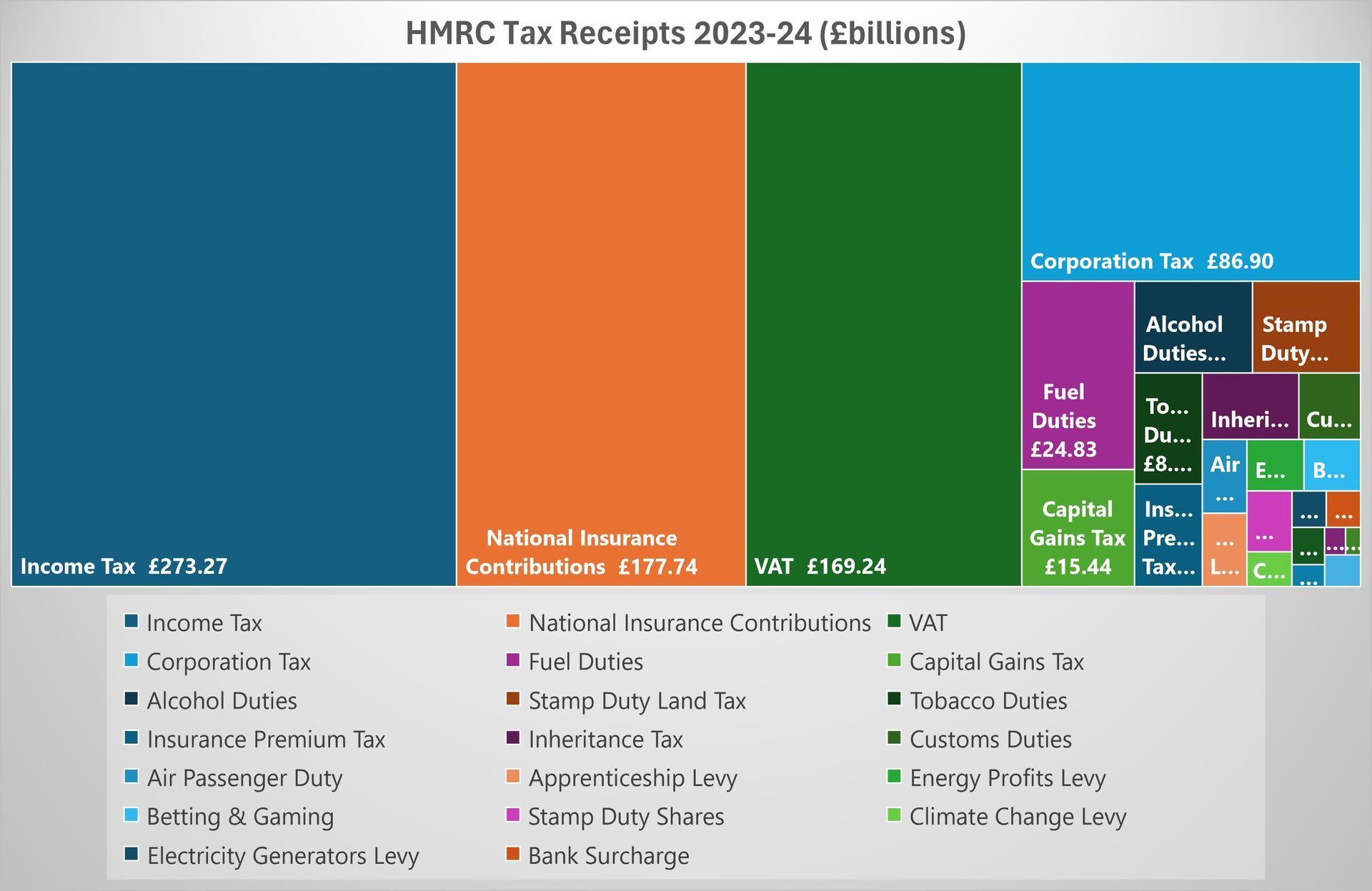

HMRC's latest tax receipts reveals some interesting trends. Overall tax revenue reached an estimated £827.74 billion in the 2023-24 fiscal year, a significant 5% increase compared to the £788.59 billion collected in the previous year. However, some sectors saw unexpected changes, raising questions for future planning.

Income Tax Boom: A Sign of Growth, Inflation or Frozen Thresholds?

The substantial 10% rise in Income Tax receipts, reaching £273.3 billion, is a double-edged sword. While it indicates the possibility of economic activity and potentially higher wages, it is certainly fuelled by fiscal drag forcing people into higher tax brackets, as thresholds were frozen again.

National Insurance Reduction: What if it had not been reduced?

The slight increase in National Insurance receipts to £177.7 billion, despite the rate reduction from 12% to 10%, suggests that the treasury was expecting a significant boost in its revenue for all the reasons noted above. However, the further decrease to 8% in the current tax year might lead to stagnant or even declining revenue in this area.

Corporation Tax Hike: Filling the Gap, But for How Long?

The significant rise of 11.7% in Corporation Tax receipts, driven by the egregious rate increase to 25%, reaching £86.9 billion, suggests this change may have achieved its aim of boosting government coffers. However, the long-term impact on business investment and competitiveness needs to be monitored.

VAT: Steady Growth, Reflecting Consumer Spending

The moderate growth of 6% in VAT receipts, climbing to £169.2 billion, aligns with expected trends in consumer spending. However, with inflationary pressures impacting household budgets, it remains to be seen if this growth can be sustained.

Beyond the Headlines: Concerns and Opportunities

The continued rise in tax penalties to £826 million, a significant increase of 8.3% compared to last year, highlights the need for improved tax compliance measures, whilst also supporting small businesses and individuals struggling to keep up with their tax bills.

The increasing trend in Inheritance Tax revenue, despite frozen thresholds, with receipts growing by 5.6% to £7.5 billion, suggests a need to review the system as many more estates are falling outside of the nil band rate due to increases in property value.

Decreases and the Road Ahead

The unexpected decline of 8.9% in Capital Gains Tax receipts, despite reductions in the Annual Exempt Amount, from £16.9 billion to £15.4 billion, warrants further investigation. Did investors adjust their strategies? Was there a shift in asset classes? Understanding these factors is crucial.

The significant drop of 24.4% in Stamp Duty Land Tax receipts, to £11.6 billion from £15.4 billion, reflects the cooling property market due to rising mortgage rates. This trend may continue, requiring the government to explore alternative revenue sources in the long run.

The decline in Fuel Duty revenue, down marginally by 1.2% to £24.8 billion from last year's £25.1 billion, while expected due to the shift towards electric vehicles and remote work, presents a challenge. The government needs to develop strategies to replace this lost revenue stream and support the transition to a greener economy.

Conclusion

While HMRC's data shows an increase in tax receipts fuelled by the highest burden on taxpayers for 75 years, with total collections reaching £827.74 billion, there are concerns about future sustainability. There must be a concerted effort to address public finances as the current level of spending and taxation is untenable.

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: