Share it out

The tax team at Friend Partnership Limited discuss a number of tax planning opportunities available to OMBs.

Owner managed companies have a number of tax planning opportunities which are not available to larger companies. This is particularly so with regard to equity participation and reward. It is well established that a payment of a dividend is a more tax efficient means of extracting profit from a company than say salary. This is important for the owner managers, their families and those who work for them.

Some available opportunities are:

- Tax efficient extraction of profit;

- Use of basic rate bands with “alphabet” shares for spouses and family members;

- Incentivisation of staff with tax efficient share options;

- Can selectively target and reward key individuals;

- Changing remuneration packages to maximise tax savings;

- Gifting shares where share valuation is low – start-ups for instance; and

- Capital Gains Tax savings with an onward sale.

Some issues to consider are:

- Share valuations;

- Shareholders’ agreements;

- Potential for ‘irritating’ minorities; and

- Good and bad leaver provisions.

All owner managed companies should be considering their shareholding structure. In most cases some very simple changes could make a material difference to the tax liabilities for those involved with the company.

Please contact us if you would like to explore some of the tax planning opportunities which may be available.

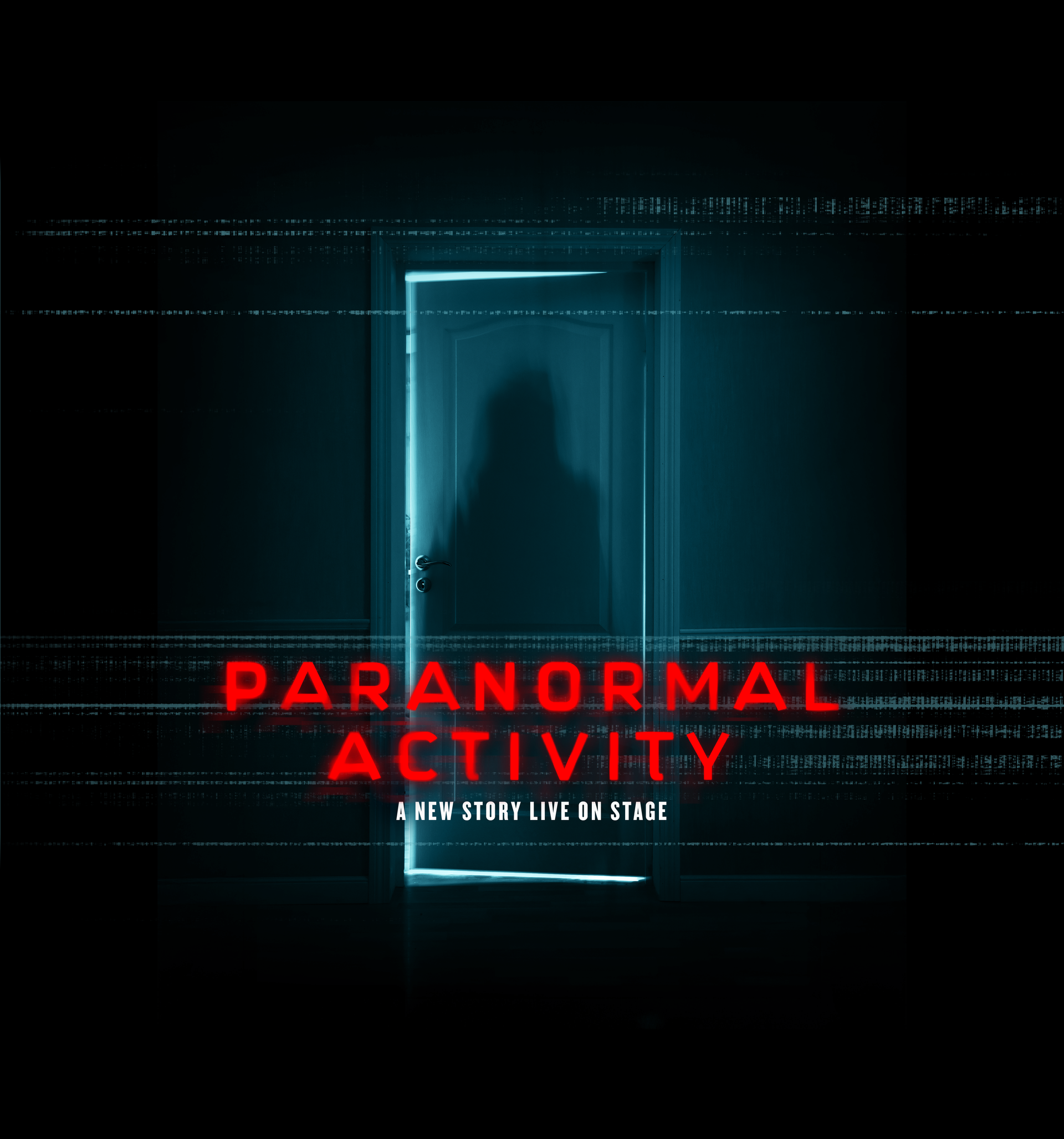

The year’s best staged production? Critical Acclaim for Melting Pot Productions’ Paranormal Activity

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: